ARTICLE AD BOX

- Long-term Bitcoin holders are staying put despite market volatility, showing confidence in the ongoing bull cycle.

- Bitcoin options trading volume surged over 180%, suggesting rising short-term speculation and hedging activity.

Bitcoin price briefly tested the lower level to near $98,000. However, not long after, the largest digital asset immediately bounced back to the $101,500 range. Although many voices have begun to discuss the possibility of a double top pattern and pessimistic tones are increasingly heard, data from on-chain analysis shows a slightly different story.

Avocado Onchain, an analyst from CryptoQuant, said that Bitcoin is currently still in a fairly calm consolidation phase. Based on the Binary CDD 30-day Moving Average indicator, long-term holders do not appear to have made any major sell-offs.

The indicator value approached 0.6 before starting to decline, and this is quite far from the number 0.8 – which is usually an alarm for a major correction in the previous cycle.

Source: CryptoQuant

Source: CryptoQuantBitcoin Volume Increases, But Large Holders Remain Resist

If we look at market activity, the atmosphere is actually getting busier. The latest data from CoinGlass shows that BTC’s daily trading volume has jumped drastically in the last 24 hours, increasing by 59.26% and touching $138.56 billion. This increase indicates that both retail and institutional traders are involved in the volatile price dynamics.

Source: CoinGlass

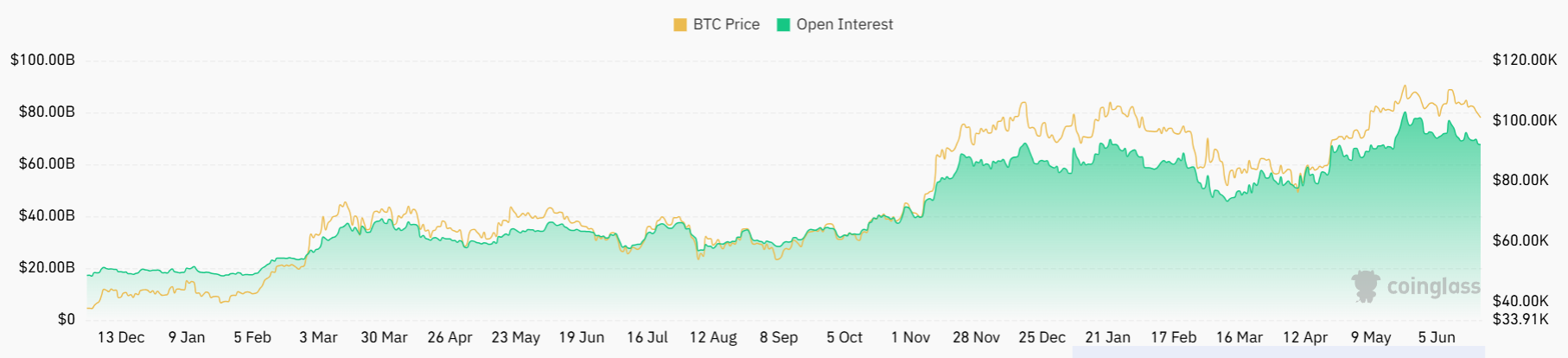

Source: CoinGlassOn the other hand, Open Interest also increased, although not as drastically as spot volume. The increase was recorded at 0.47%, and is now at the level of $68.37 billion. This means that the positions opened—both long and short—are still being maintained. Not many have rushed to exit the market.

But the most surprising part came from the options sector. Bitcoin options trading volume exploded by 181.24% in a short time, with a total value reaching $6.02 billion. It could be that many are starting to use this instrument to speculate or anticipate extreme price movements in the short term.

Signs That the Market Is Not Ready to Give Up Yet

Although these figures show a fairly striking increase in activity, Avocado Onchain continues to emphasize that there is no signal that the current bull cycle is over. According to him, the pattern that is currently occurring is reminiscent of the previous two phases where Bitcoin formed a “ladder”—consolidation first, then continued to rise again.

Furthermore, CNF also previously reported that large Bitcoin outflows and stablecoin inflows from whales indicate that confidence is starting to recover. This means that risk appetite is slowly returning.

Interestingly, even though the price has fallen by around 5% in the last 7 days, long-term holders remain unmoved. Like people who are used to going up and down mountains, they know when to stay still and when to move. They actually see this phase as part of the journey, not the end of the story.

Not only that, this “quiet” phase is also often a sign that the next big move is being prepared by the market. So, even though voices of doubt are starting to be heard from all corners, on-chain data and derivative activity actually show that the market has not given up—it is just taking a breath.

.png)

3 hours ago

2

3 hours ago

2

English (US)

English (US)