ARTICLE AD BOX

- Bitcoin (BTC) is reported to have become bearish as analysts tip the asset to fall below the $99k level.

- Analysts have also disclosed that three factors – weakening momentum, macroeconomic uncertainties, and daily active addresses could contribute to this price fall.

Bitcoin (BTC) has been trading within a tight range in the past ten days, hovering within the $101k and $105k levels. According to our market data, the asset has rallied by 2% in the last 24 hours, trading at $105k.

Fascinatingly, analysts believe that there could be a correction that would see the asset falling to $99k. Supporting this analysis, three reasons were cited:

Weakening Momentum

The Bitcoin technical chart has been showing lower highs, hinting at a fading momentum. According to analysts, Bitcoin’s Relative Strength Index (RSI) has also reached the overbought territory of above the 70 level. Above all, the price is trending within the upper limit of December 2024 and February 2025, confirming a possible downside.

Looking into other metrics. We found that the Auction Market Theory has hinted that Bitcoin could continue its downside to find support at the $93k.

Drop-in Addresses

On-chain data shows that Daily Active Addresses have been declining in the past few days. According to our analyst’s interpretation, this implies that investors have been leaving the Bitcoin blockchain.

The last time this happened in large quantities was in February, when the number of active addresses dropped to below the annual average, hitting 1.1 million. At that time, the daily transaction volume also saw a drop from 402k to 350k.

If the current trend continues, Bitcoin could lose its support at the $101k level and subsequently the $100k level. At worst, the asset could fall to as low as $84k.

Macroeconomic Conditions

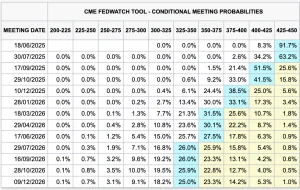

Currently, investors remain uncertain about a rate cut announcement. According to the CME Fed Watch, there is just an 8.3% chance of a rate cut in June. Meanwhile, the chance of a rate cut in July was increased to 34.2%.

Source: CME Fed Watch

Source: CME Fed WatchHighlighting this, Jim Bianco’s research has also hinted that there is a 51% possibility of a rate cut in September. As long as these estimates remain, the future of Bitcoin would continue to be bearish unless a more severe price-determining factor forces an upsurge. Meanwhile, Bank of America earlier predicted that there could be four rate cuts this year, as highlighted in our previous news article.

Contrary to this bearish outlook, analyst Scott Melker has predicted that Bitcoin could defy the odds and hit $250k by the end of the year.

250K this year, totally possible…It used to be about three times as volatile as the S&P. Now it’s less than two times…The more institutional money, the more Wall Street money, the more long-term holders get involved, the less volatility there’s going to be.

For the asset to return to bullish ways, it would have to totally overturn the current trend by making a decisive move above $104k. As featured in our previous news coverage, a subsequent move above the $109k level could see the asset starting a new explosive run.

Analysts have also hinted that any massive surge could be triggered by the aggressive accumulation of whales. As indicated in our recent news brief, whales have purchased 83,105 BTC in just 30 days.

.png)

5 hours ago

5

5 hours ago

5

English (US)

English (US)