ARTICLE AD BOX

- Bitcoin jumped over 16% in two weeks, now near $123K, passing Amazon and Silver in value.

- Spot ETFs keep pulling big inflows, over $1B on Friday alone, pushing price momentum higher.

Bitcoin has started July with steady momentum, posting an average daily rise of around 1.2%. Beginning the month near $105,000, it has now reached $122,546 as of July 14. This marks a 16.71% gain in just two weeks, its fastest rally in months.

At the current level, Bitcoin’s market value has surged past $2.4 trillion. It now ranks as the world’s fifth-largest asset, overtaking Amazon at $2.3 trillion, Silver at $2.2 trillion, and Google-parent Alphabet at $2.19 trillion. It sits only $730 million short of surpassing Apple’s valuation.

The climb comes amid a noticeable increase in institutional support. Since June 5, the number of companies holding Bitcoin has more than doubled, rising from 124 to over 265. Together, they now hold about 3.5 million BTC in their treasuries. Public firms alone control 853,000 BTC — about 4% of all coins — while spot ETFs hold another 1.4 million, equal to 6.6% of the total supply.

ETF Inflows Drive New Highs

Spot Bitcoin exchange-traded funds’ investment support was largely the driver of price momentum. The ETFs experienced net inflows amounting to over $1 billion on Friday, continuing their seven-day winning streak of steady investments, according to Farside Investors.

The trend is following earlier surges in February when ETFs held 75% of all total investments in Bitcoin during a two-week stretch. That earlier inflow surge took Bitcoin above $50,000, and the current trend is set to do the same at higher levels.

Institutional demand is becoming a long-term price driver. “The narrative has completely shifted: no one is talking about blockchain use cases or Bitcoin’s technological promise anymore,” said Markus Thielen, research lead at 10x.. “Bitcoin has become a macro asset, a hedge against unchecked deficit spending.”

Bitcoin Gains Policy Tailwinds in U.S.

Investors are also watching developments in Washington, where three important crypto-related bills are under consideration from lawmakers in the “Crypto Week” category. The bills are the GENIUS Act, the CLARITY Act, and a bill against the launch of a central bank digital currency.

That policy momentum is building investor sentiment, in line with general equity market optimism. “This is an indication that upside momentum may start to pick up, allowing Bitcoin to rally further,” said David Morrison at Trade Nation.

Russian crypto analysts predicted Bitcoin may hit $150,000 before 2025’s end. The prediction is grounded on structural buying support from institutions as well as additional U.S. accommodative monetary policy anticipations.

Thielen added that Bitcoin is no longer a tech asset but is a response to weakening U.S. fiscal fundamentals. With the interest rate poised to fall and deficit spending continuing, Bitcoin is positioned as what Thielen calls the “ultimate beneficiary” in the present environment.”

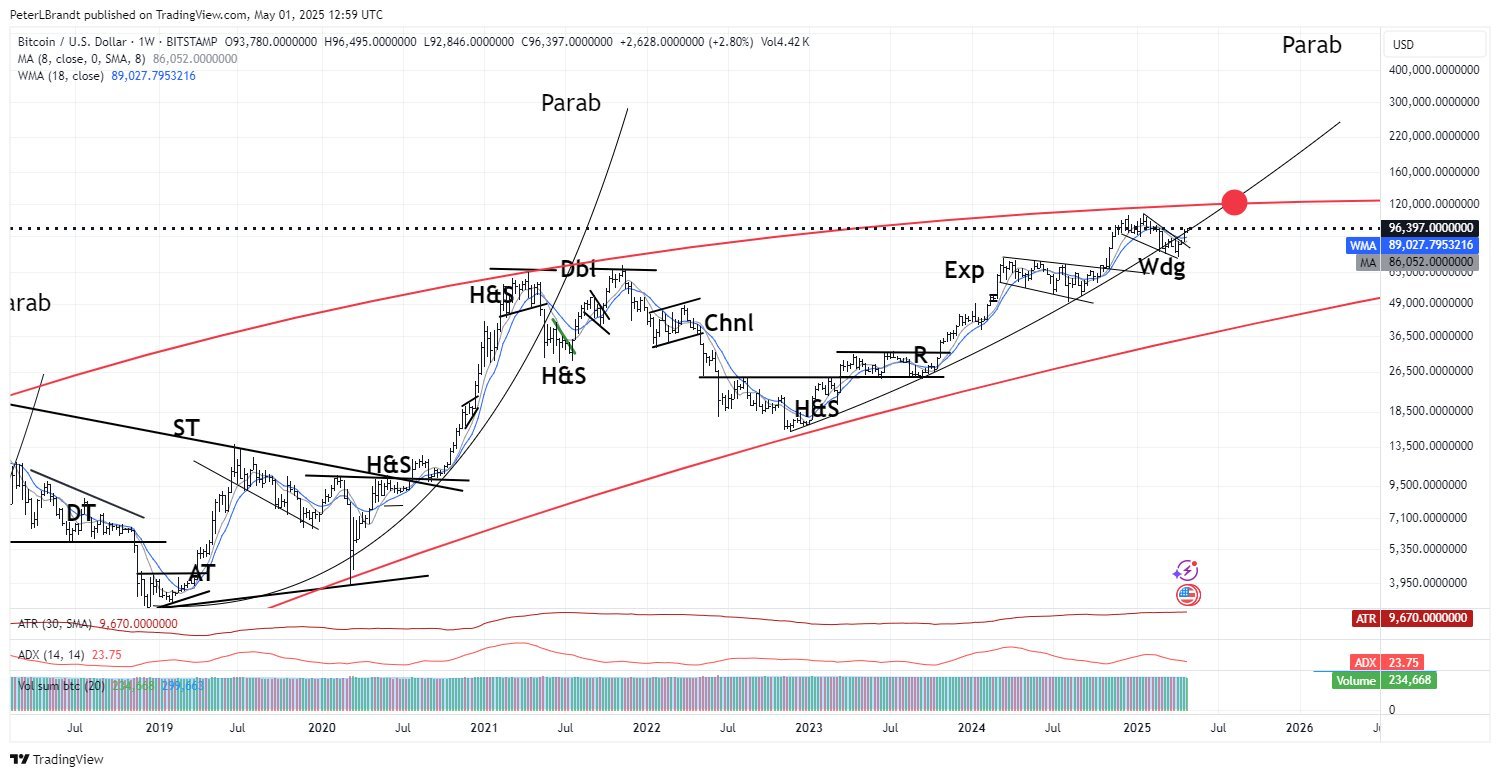

In May 21 analysis, Veteran trader Peter Brandt said, “On track maybe for top of $125,000 to $150,000 by end of August????” His chart-driven projection aligns with the prevailing sentiment among certain market analysts that Bitcoin’s upward momentum may still have room to extend.

Source: X

Source: X.png)

3 months ago

7

3 months ago

7

English (US)

English (US)