ARTICLE AD BOX

- AVAX holds above $25 with bulls defending the channel, momentum slows as volume dips slightly.

- Open interest surged to $650M in early May, aligning with a price spike from $20 to $25.

Avalanche (AVAX) continues to gain traction as its price flirts around $25. This price has served as a resistance level since last Sunday and is a pivotal level for any upward continuation. As of the last price check, AVAX traded around $25.15, remaining within an uptrend channel. Should bulls successfully clear this resistance level, the subsequent test should happen around the psychological $30 level.

Source: TradingView

Source: TradingViewThe trend is supported by technical strength. AVAX once again retested the 100-day Exponential Moving Average (EMA) of $23.20 last week before resuming its uptrend. This support rebound gives more confidence-building for the buyers moving towards the 200-day EMA, which is being retested again. Any sustained close above this moving average may add more optimism to the buyer’s sentiments.

Signs of positive change are also evident in the Relative Strength Index (RSI). At 64.48 on the daily chart, it is creeping toward its overbought threshold of 70. This reading is a bullish indicator but is a warning signal as well. A breakout above 70 might represent prolonged strength or a forthcoming short-term pullback.

Open Interest Soars to $650M

In early May, open interest rose above $600M to around $650M on May 10–11, according to CoinGlass. During this period, the price of AVAX rose from below $20 to over $25. Both price and open interest jumps in this manner might indicate increased speculative action or more aggressive market participation on these dates.

Source: CoinGlass

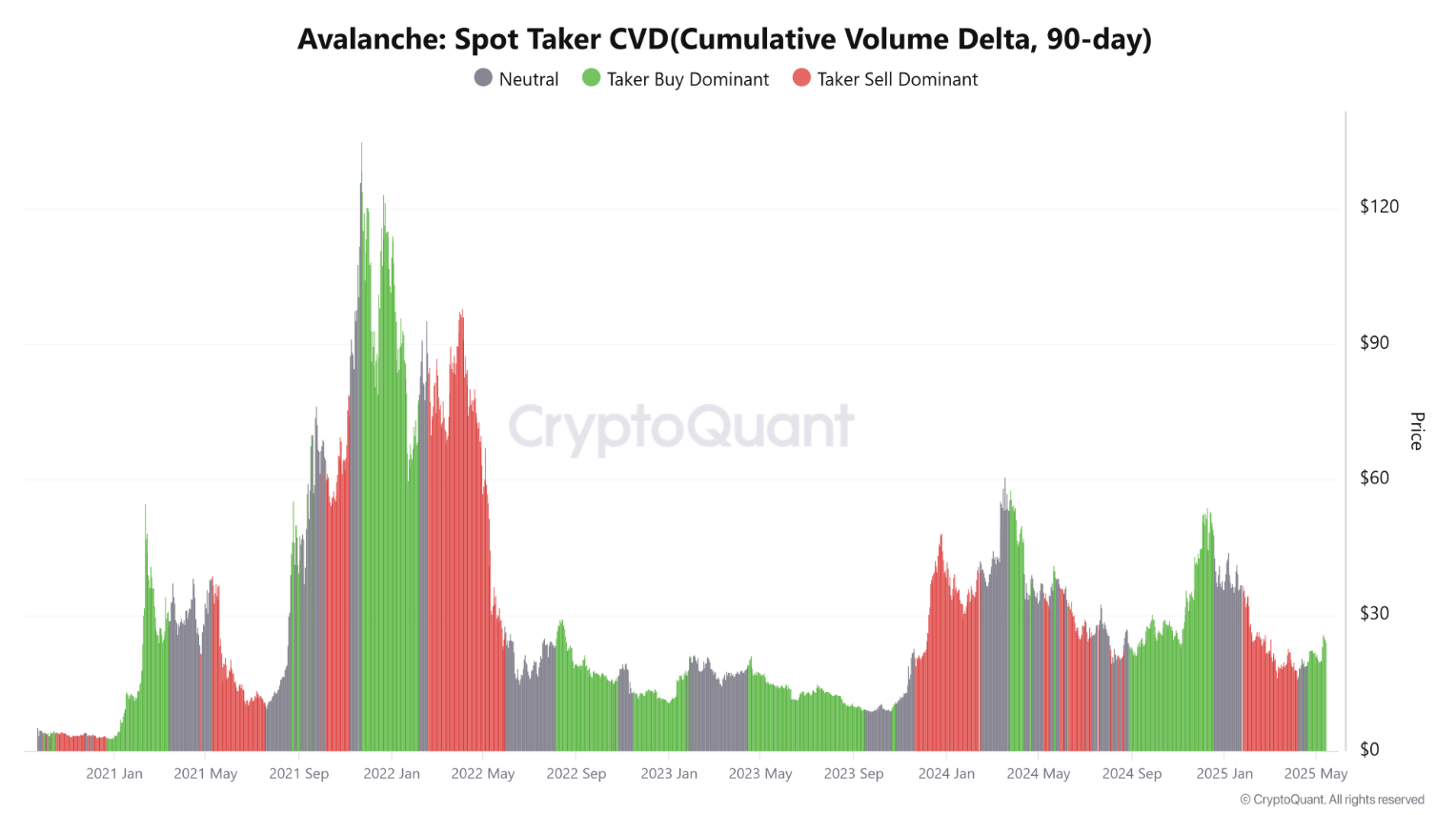

Source: CoinGlassCryptoQuant’s gauges further affirm the trend. 90-day Taker Cumulative Volume Delta (CVD) has remained positive and ascending from the start of May. The growth indicates that buy-side volume is outweighing sell-side volume in this time frame. When there is a positive and ascending CVD, a Taker Buy Dominant Phase is common and is typically found in a positive price trend.

Source: CryptoQuant

Source: CryptoQuantIn spite of the bullish indications, volume has edged lower in recent sessions. Such a decrease may signal decelerating momentum, particularly if buyers cannot force the price over $27. Falling from current levels could see a retest of support close to $22 to $23 if the pace slows near the upper boundary of the ascending channel.

Bulls Defend Key Channel Despite $27 Pullback

AVAX’s action within the uptrend channel is still intact, which tends to indicate price continuation in the near-term. The recent pullback from the level of just shy of $27 failed not with a breakdown but with signs of bullish resilience. Both price action and structure remain positive as of the current moment as long as key levels continue.

Any rejection around $26.07 in the near term is likely to see a retracement. The most probable fallback level of that scenario would be the 100-day EMA of $23.19. The zone there is likely to become a new base if selling does not intensify further.

The short-term trajectory of AVAX is set to follow the uptrend path, with price fluctuating within a defined ascending channel and increasing participation evident on-chain. A clear breakout over $27 would open the route for the next resistance range around $30.

.png)

3 hours ago

1

3 hours ago

1

English (US)

English (US)